Financial Planning

We provide clarity on your current financial situation, assess if you're on track for success, and outline actionable steps needed to reach your goals.

Investment Solutions

Grow and preserve what you've earned. We have the flexibility to build portfolios to solve for a wide range of current and future needs.

Estate & Gift Planning

Navigating the complex world of legal and tax strategies can be overwhelming. We identify, analyze and help you implement the most appropriate wealth preservation tools available.

Risk Management

Protecting your life and your family is a top priority. We help you understand your current level of risk exposure and how you can mitigate it cost effectively.

Tax Planning

Our goal is to help you pay less taxes, and reduce the time you spend preparing them. We implement proactive tax strategies throughout the year, and communicate directly with your tax preparer.

Business Owner Advisory

We specialize in working with business owners and the unique challenges they face as entrepreneurs. Our framework provides the support needed to give you time to focus on your business.

Public Stock Options

We have a personal expertise in trading and analyzing stock options for income, risk mitigation and other strategies. If you have an interest in learning how this could compliment your portfolio, reach out.

Retirement Planning

Spending from your portfolio can look like a confusing problem with many possible answers. We can help you develop the right spending plan, ensuring your portfolio supports your desired lifestyle.

Special Needs Planning

We help caretakers find a balance between the competing goals of planning for their own financial security and planning for the lifetime needs of their dependent with a disability.

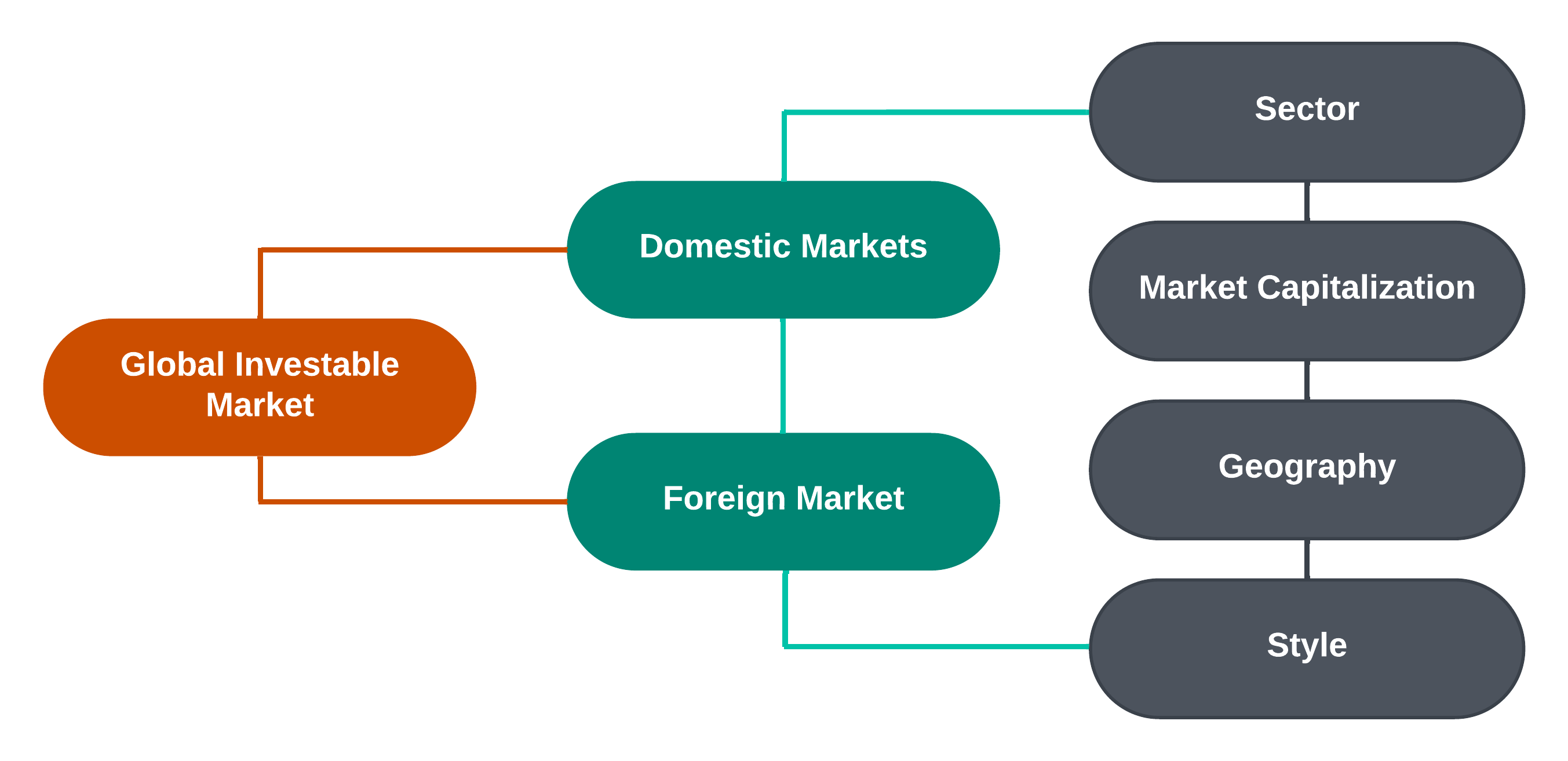

Investment Solutions

The design and implementation of your investment strategy plays a crucial role in managing your financial health. Our portfolios are designed not only to maximize returns, but to meet the specific goals and intentions of the investor. In pursuit of this, we apply an evidence-based investment approach supported by over 80 years of peer-reviewed financial research and market studies.

Each investment in our client portfolios is intentional, calculated, and a key driver in expected return. Though each investor is unique, we believe in the following core tenants for your investing journey.

- Embrace the overall market

- Reduce taxes and expenses

- Have a plan & be disciplined

Our approach is dynamic; we don't subscribe to a set it and forget it mentality. Instead, we actively monitor your investment portfolio as market conditions or your objectives evolve.

Meet the Team

Founder | Managing Partner

Founder | Managing Partner

Director